Exclusive first look at the Alpha version : Bridge Finance

As our Alpha version launch draws near, here are some exclusive screens of what the platform’s front end will look like

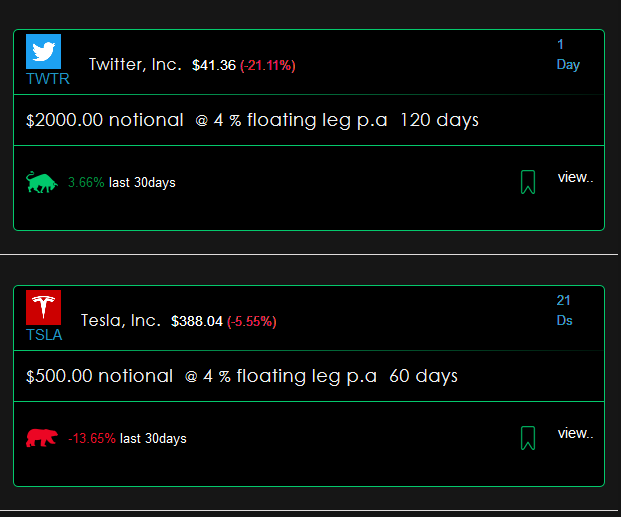

The design is simplistic, neat and elegant to allow for ease of use, even for non-crypto enthusiasts. The main timeline displays the currently available Equity Swap Deals or Contracts which you can take up provided you have staked the required amount of tokens as collateral to become a Taker.

The feed on your timeline can be switched by simple tabs or a search bar to live-filter content by keywords, amount or Stock Ticker. Validate/ThotBox allows you to share ideas with others and get feedback to help you decide on your next Equity Swap deal. In the future, it will add leaderboard and blogs.

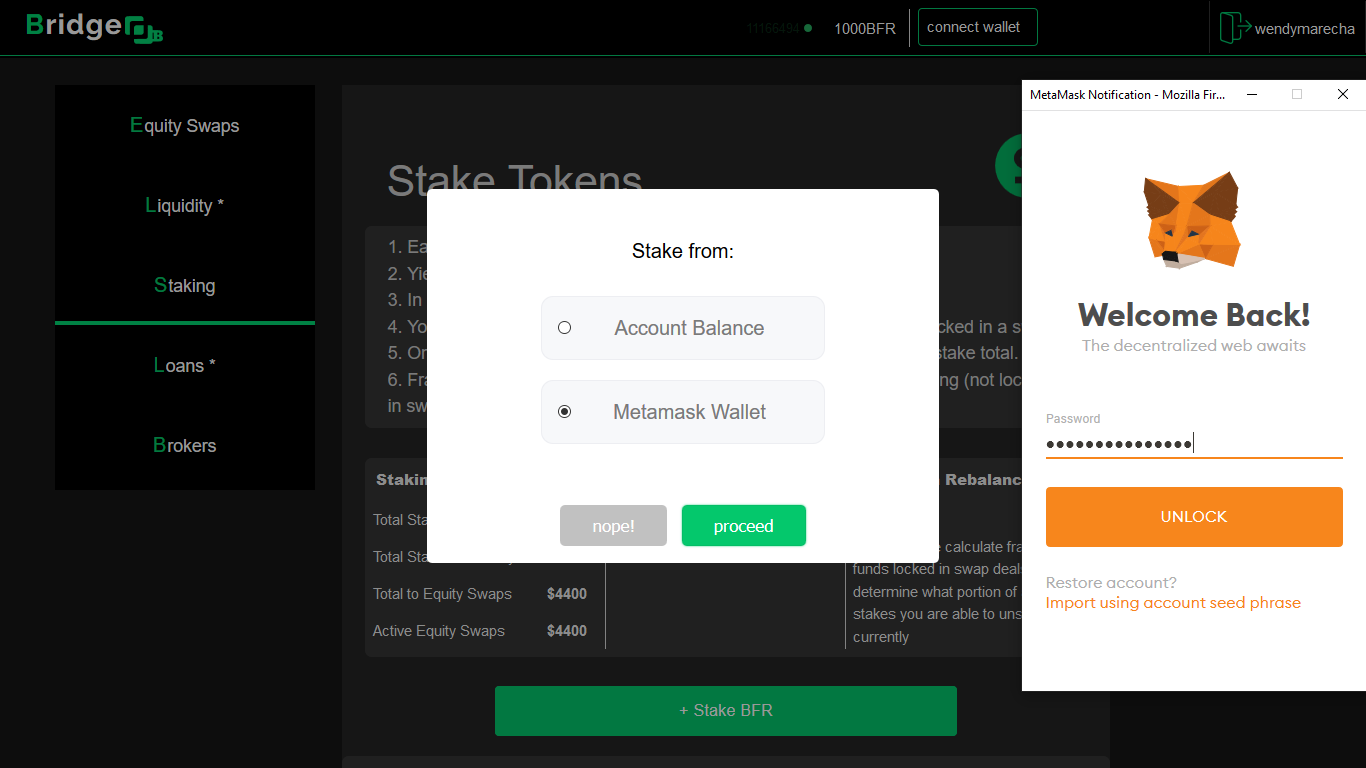

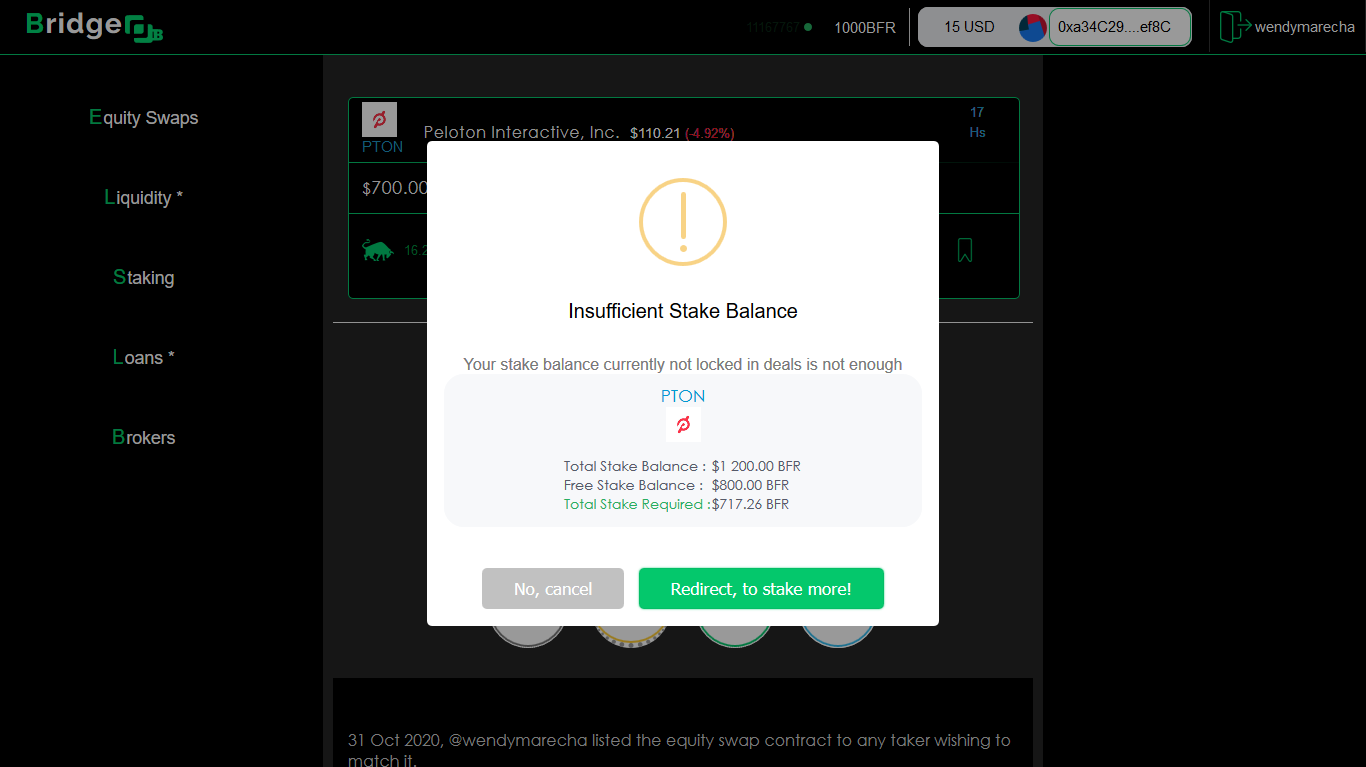

In order to create a Equity Swap contract for your stock as the Maker, or to be a Taker in one, you are required to stake tokens as collateral with our smart contract. Staked tokens can be unstaked at anytime provided you have no active equity swap deals running using the stake as collateral.

The platform does not store your funds or hold your keys in anyway, its all non-custodial with a Metamask integration. For Makers only, they have the option of having funds in a separate account balance smart contract from their broker. To stake you simply connect your wallet, choose amount and duration, then confirm/sign transaction in Metamask, after 24 block confirmations your funds will be staked.

Each Equity Swap contract is viewable at any stage of its progression: listing, running or maturity. To take up a contract you need to have enough liquidity as collateral staked. You can bookmark your contracts or simply navigate to the one you are a party in to track it live, with live gains or losses for each party as per Stock price movement. All the way up to settlement where either party can then trigger a call to the smart contract to get payment.

Each swap contract displays the live price changes / percentage gains for the day or the last 30 days, thanks to the use of oracles which interface through our switch protocol to determine an accurate average in real time. On contract creation, you simply have to know the ticker symbol, type it, then it fetches the data: stock name, logo, latest price etc all by itself for the lifespan of the contract. With 99.99% accuracy!

Alpha version launch is scheduled to be this week. We cant wait to share it with you. Follow our official channels for updates as it happens.

https://twitter.com/_bridgefinance

Don’t know about us? read more about us on our website: Bridge Finance